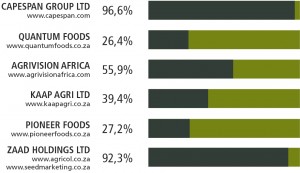

Pioneer Foods (30%)

Pioneer Foods is a leading food and beverage producer in Southern Africa, with an annual revenue in excess of R20bn. It boasts an impressive leadership team, intent on optimising current operations and growing into new and international markets by leveraging its broad consumer product basket and state-of-the-art infrastructure. Supplying over 80 countries, the group’s product portfolio spans bread, biscuits and meat to carbonated drinks, fresh produce and some of the world’s best-known cereal brands. Zeder has a significant interest, roughly 30%, in the group through its investment in Kaap Agri.